Find answers to common questions here.

Your personal investment performance may differ to the fund performance depending on when and how much money was contributed to your account, or deducted from your account, over the course of the year.

PermalinkFuture Super is a unitised fund, which means that every time a contribution is made into your account, you are issued units in your chosen investment option. This also means that when you are paid a benefit or money is deducted from your account (for example, for fees or insurance premiums), a portion of your unit holdings are sold.

Your balance is therefore calculated as the number of units you hold multiplied by the unit price on any particular day.

PermalinkThe unit price for all members of the fund (the value of a unit) is calculated every week day and changes based on the value of the assets the fund invests in, as well as the fees and taxes that are due and deducted from the value of the assets.

As the unit price fluctuates so too will your balance. This is because your balance is calculated as the number of units you hold multiplied by the unit price on any particular day.

PermalinkYou can find your total investment earnings on the front page of your member statement under Account Summary. Please note that your investment earnings shown are net earnings after all fees and taxes.

You will also find the net earning rate of return under the Investment Performance section. Your personal investment performance may differ to the fund performance depending on when you rolled in, and when and how much you contributed or withdrew over the financial year.

PermalinkYour total fees includepercentage-based fees, which will differ based on which investment option you have chosen and is included as part of the unit price calculation. This includes the investment fee, percentage-based administration fee and indirect cost ratios. These are referred to as fees and costs deducted from your investment in your annual member statement. These do not show in your transaction history.

Your total fees also includes a flat administration fee, that is deducted directly from your account on a monthly basis. This is referred to as the fees deducted directly from your account annual member statement.

You can find the total fees for each investment option outlined on the Investments Options page of our website.

A detailed breakdown of the different fees incurred by each of our investment options is available on pages 26- 30 of our Additional Information Booklet.

PermalinkThe investment fee, percentage-based administration fee and indirect cost ratios are accrued and reflected in the unit price when the unit price is calculated, and paid in arrears. These fees are not deducted directly from your account.

The deductions listed on the first page of your member statement include the fees and costs that have been deducted directly from your account, including contributions tax and the flat dollar-based administration fee.

Under the Protecting Your Super legislation, accounts with a balance under $6,000 have a 3% fee cap. In order to comply with this legislation, the flat (dollar-based) administration fee is waived for accounts with balances under $6,000.

However, this fee cap is assessed at a particular point in time (for example, at the end of the financial year, on the 30th of June, or on your account's date of exit). This means that, if your account balance moved over the $6,000 threshold over the course of the financial year but then fell back under the $6,000 threshold, fees may have been charged on the higher balance during the year and the 3% fee cap will have been exceeded. Therefore, a rebate was paid to your account to ensure that we did not overcharge fees.

PermalinkGenerally, no.

If you need confirmation that your personal contributions and your Notice of intent to claim a deduction for personal contributions has been applied to your account, you should be able to use your Letter of Acknowledgement . Your Letter of Acknowledgement should be sent to your 5 business days after your Notice of intent has been processed.

You may also be able to use a Interim Account Activity Statement, which you can request via email at info@futuresuper.com.au or over the phone on 1300 658 422.

If you have withdrawn funds from your account, your benefits may be subject to tax and you should have received a Payment Summary for this

PermalinkPreserved benefits include all contributions made by you or on your behalf since 30th of June 1999 and the investment returns gained from these contributions.

Examples of contributions include employer super guarantee payments, or personal contributions.

Preserved benefits cannot be accessed unless a condition of release is met.

Please see our FAQ on conditions of release for more information.

PermalinkRestricted non-preserved benefits refer to employment-related contributions (other than employer contributions) made before 1 July 1999.

You can't access this type of benefit until the related employment arrangement has been terminated.

PermalinkUnrestricted non-preserved benefits are the portion of your funds that you can access, as you have already met a condition of release to access your super. These benefits can be paid to you at any time.

Typically, retired members who have chosen to leave money in their super fund will have this type of benefit.

PermalinkThe Annual Member Statement shows the balance of your account as at the 30 June of the previous financial year. This would be different to the account balance displayed currently online which would be calculated based on the latest unit price.

Your closing balance at the end of the financial year may also include some non-preserved benefit, which is dependent on your circumstances.

PermalinkYou can find out about the insurance coverage you hold on page 2 of your Annual Member Statement, under the heading “Your insurance cover”.

Additionally, you can find more information about the insurance coverage you hold by logging into your online account and clicking the Insurance tab.

If you would like to learn more about applying for insurance coverage, please see our FAQ on insurance or get in touch with us at info@futuresuper.com.au.

PermalinkThe numbers next to your name are numbers used to identify you and your account. Next to your name you should find your member number followed by your account number. This will appear in the format b'MMBRXX-ACCTXX' and may have the prefix b'FS'.

PermalinkThe super contributions paid to your account from your income before tax are taxed at 15% and called b'concessional' contributions. This can include employer contributions, such as compulsory employer contributions (employer super guarantee contributions) and salary sacrifice payments made to your super fund, as well as personal contributions for which you have notified us you are intending to claim a tax deduction.

Permalink“Benefits Paid” (listed within the “What has been deducted from your account” section of your member statement) refers to the total amount that has been withdrawn from your super account during the financial year.

PermalinkIn the 2023-24 financial year, the super guarantee rate that your employer was obligated to pay was 11.00% of your annual income.

Note, effective from 1 July 2024, the super guarantee rate is now 11.5%.

You can review the total contribution amount that your employer has paid into your account on the first page of your annual member statement....

PermalinkSuperannuation is a compulsory government scheme to help you save for retirement. Your employer pays mandated contributions to your super and you can also contribute funds to it yourself if you wish to. This money is then invested on your behalf by your super fund.

One of the benefits of super is that it is designed to be a tax-effective way to save for your retirement, with contributions and investment earnings in your super fund typically taxed at a lower rate than your normal earnings. Super is saved for your retirementand can be accessed when a condition of release is satisfied.

PermalinkMost people have the option of choosing their own super fund. All you need to do is provide your employer with the details of your preferred super fund. If you don't specify a super fund, your employer will likely create an account for you with their default super fund.

A small number of people are not eligible to choose their super fund, due to Enterprise Agreements with industry funds. You will need to speak to your employer to find out if this is your situation.

PermalinkFinancial markets have been volatile over the last few years. Russia's invasion of Ukraine, fossil fuel prices temporarily surging and inflation have all been important issues for our investment team to navigate on your behalf. We're proud to let you know that despite these headwinds, we've delivered strong results for you over the last financial year.

Future Super's Balanced Index option ranks among the top Balanced Options in the country for the last Financial Year, based on the SuperRatings SR50 Balanced Survey.

All of our options performed well over the last year.

Balanced Index returned 10.5% for FY23 and 4.1% for the June quarter. That puts it among Australia's top 5 sustainable balanced options over 1 year, as measured by SuperRatings, significantly outperforming the SuperRatings median Balanced investment option return of 8.5% for the year.

Renewables Plus was also a top performing option, delivering 9.7% for FY23, also significantly outperforming the median option in its category.

Members in Balanced Impact saw strong returns of 8.5% over the financial year and 2.5% for the last quarter alone.

See Performance & Returns for the latest performance of each of our investment options.

Returns provided are after investment fees, percentage-based administration fees and taxes but before dollar-based administration fees have been taken out. Returns for periods of greater than one year are on a per annum compound basis. Return of capital and the performance of your investment in the Fund are not guaranteed. Past performance is not a reliable indicator of future performance.

PermalinkNo strategic changes have been made as a result of recent negative returns and higher volatility in share markets. Future Super takes a rules-based approach to investment, which aims to deliver results over a longer term time horizon.

We continue to believe it is possible to invest in a way that has a positive impact on the world, and with ethics in mind, while also providing for our members' retirements.

After the surge in fossil fuel prices in 2022, there was some debate in the media about whether super funds could deliver great returns for members and act on climate change.

Super is a long term investment. It's designed to see you through your whole working life and into retirement. At Future Super, we believe the threat of climate change should be front of mind in our long-term investment thinking. We also believe in investing in a future that is worth retiring into.

Our screening work to protect you from what we believe to be harmful assets remains consistent, but this year it's given us a performance edge. Thanks to our screens, we've been more heavily invested in the sectors that have performed the strongest this past financial year.

We screen out many of the big banks, locally and internationally, because they fund fossil fuel projects. And recently, performance for bank stocks has been held back by recession fears.

Utilities (like energy companies) were one of the weakest performing sectors globally*. Future Super's screening approach paid off here too as we deliberately avoid investing in the vast majority of utilities companies due to their reliance on fossil fuels.

This sector based advantage in our portfolio was backed up by earlier decisions to move some of our income assets into being inflation linked (known as floating rate). These are the sorts of decisions our investment team makes by constantly monitoring the markets on your behalf.

We want to invest for a better future - for the world and for our members. What these positive returns show is the power of doing both at the same time.

*According to the MSCI World Index. Source: FactSet.

See How We Invest for more information about our screening and investment processes, and what we mean by fossil fuel companies and investments.

All information provided is general in nature only and does not take into consideration your personal objectives, financial situation or needs. Please read the relevant Product Disclosure Statement, Target Market Determination and Financial Services Guide available at https://www.futuresuper.com.au/documents-and-forms/ and consider whether Future Super is appropriate for your needs before investing. We recommend you seek independent personal financial advice before investing.

Past performance is not a reliable indicator of future performance.

PermalinkFuture Super doesn't have a cash option, but many other funds do. During the market volatility around the start of the pandemic some people did choose to switch to cash. Unfortunately, research found that members in the averaged super balanced option who switched to cash in April 2020 would have lost up to 27% by July 2021.

We do allocate a portion of the portfolio to cash, and in certain situations the investment team could choose to allocate more to cash if it deems that as the most appropriate action.

If you're considering options for your super, we recommend you seek personal financial advice before making a decision.

PermalinkWe're keeping your money away from fossil fuel companies that are contributing to catastrophic climate change. By being a Future Super member, you are part of the divestment movement - a movement of investors using money for good and investing in a way that seeks to reduce climate change and inequality.

We invest in all different types of assets with superior environmental, social and governance (ESG) considerations. To give you an example, we have invested in the IIG Solar Asset Fund, a renewable energy investment that owns three large-scale solar farms - Swan Hill, Chinchilla and Brigalow.Those solar assets are an example of investing in assets that aim to contribute to our overall performance while at the same time building clean energy solutions.*

When markets go down it can be a buying opportunity. And so, whilst it might be scary to see a graph go down, another way of thinking about this is it can be an opportunity to benefit from buying assets when they're cheaper.

*o;? Future Super has exposure to these assets through its investment in the IIG Solar Impact Fund. Members invested in the Future Super Balanced Impact and Future Super Renewables Plus Growth options have exposure to the IIG Solar Impact Fund. Members in the Future Super Balanced Index option do not have any exposure to this investment.

Information provided is of a general nature only and we have not taken your personal financial objectives, situation or needs into account. You should consider whether Future Super's products are right for your individual objectives and needs and seek personal financial advice. Before making a decision to acquire, hold or continue to hold an interest in Future Super, please read the PDS and check our Target Market Determination (TMD) available at https://www.futuresuper.com.au/documents-and-forms/. Future Super does not accept any responsibility for any loss or damage that may result from reliance on, or the use of, any information contained on this site. The contents of this website are exclusively owned by Future Super.You must not use or disclose them for any other reason than for the purposes for which they were supplied.

PermalinkFY22 was Future Super’s first year of negative returns since we launched in 2014.*

Even if you haven’t been with Future Super for a long period of time, whether you’ve seen your super returns go down before probably depends on how long you’ve have had a super fund for and how often you’ve looked at your balance.

The Australian and US share markets enjoyed a very buoyant period, where it was pretty rare for markets to be down by much,** from 2009 until the pandemic in 2020. It’s actually historically rare for markets to be so consistently up, and some experts consider that period the “longest bull market in history”. Between Australian shares and US shares, that’s a decent chunk of most super funds’ balanced options.*** That could be why you haven’t noticed a dip in returns before. But again, it’s so important to keep that long term perspective in mind.

* Calculated by returns at the end of each financial year for each Future Super investment option since inception. Past performance is not a reliable indicator of future performance.

** https://www.smh.com.au/business/markets/the-longest-bull-market-in-history-ends-in-a-savage-sell-off-20200312-p549c0.html https://money.usnews.com/investing/term/bull-market

*** As per ASFA and APRA statistics. In the ASFA and APRA sources, MySuper options are considered balanced.

PermalinkPut simply, divestment is the opposite of investment. It is the act of selling assets for moral, political or financial reasons.

Divestment is an effective tactic for influencing positive change. Famous examples include divestment from South Africa in the former era of apartheid, divestment of the Arms Trade, and Tobacco industry divestment.

Future Super is part of the fossil fuel divestment movement. Fossil fuel divestment is the process of selling off assets in companies that mine, process or burn fossil fuels. Future Super has also divested from companies that provide finance or services to the fossil fuel industry, such as Australia's big four banks.

The fossil fuel divestment movement is dedicated to moving out of fossil fuel companies. This undermines the social licence of the industry by telling them that they are no longer welcome to continue operating.

As well as individuals divesting their personal finances, many different organisations have also committed to divest. These include universities, churches, city councils, philanthropic organisations, insurance companies, and huge sovereign wealth funds.

Find out more about the fossil free movement here at Go Fossil Free.

PermalinkDivestment serves two purposes. Firstly, divestment delegitimises those businesses that use the power of money to cause harm. For example, in countries where the fossil fuel industry has a firm hold on all parts of society (through political lobbying, the funding of policy think tanks, etc.), divestment erodes the industry's dominance and creates the space needed for change to happen.

Secondly, divestment is most effective when coupled with re-investment. At Future Super, it is our mission to ensure that our members' money is building a future worth retiring into. By allowing our members to invest in line with their values, Future Super aims to fast track the transition away from coal and into a future free from climate change and inequality.

PermalinkWe take a holistic approach to investing that covers a wide range of ethical issues. We do not invest in companies or activities that cause social or environmental harm, such as detention centres, live animal export, tobacco, and armaments, to name a few. This is known as b'negatively screening' companies.

Further to this, we also seek out positive investments in industries that provide benefits for the environment, society and the economy. These investments include renewable energy and energy efficiency, water and resource conservation, healthcare, education, electric transport, green infrastructure and more. This is called b'positive screening.'

Money is powerful, and we believe that applying both negative and positive ethical screens to the assets we consider investing in will provide us with an investment portfolio that will build a world free from climate change and inequality.

You can find out more about how we invest on our website.

PermalinkTo find out what your super fund's exposure to fossil fuel investments is, you can look them up on SuperSwitch. SuperSwitch is an independent resource by non-profit group Market Forces to help people find out how their super is fuelling climate change. If they're not listed on here or have not disclosed their exposure, you can contact them directly.

PermalinkThe easiest way to join Future Super is through our online join form. It takes just a couple of minutes. You can also join over the phone on 1300 658 422.

For all the important information needed to make an informed decision about joining Future Super please read ourProduct Disclosure Statement, Target Market Determination, Financial Services Guide, Additional Information Booklet and Insurance Guide.

PermalinkIf you don't know your Tax File Number (TFN), you might be able to find it by:

If you still can't find it, you can contact the ATO on 13 28 65.

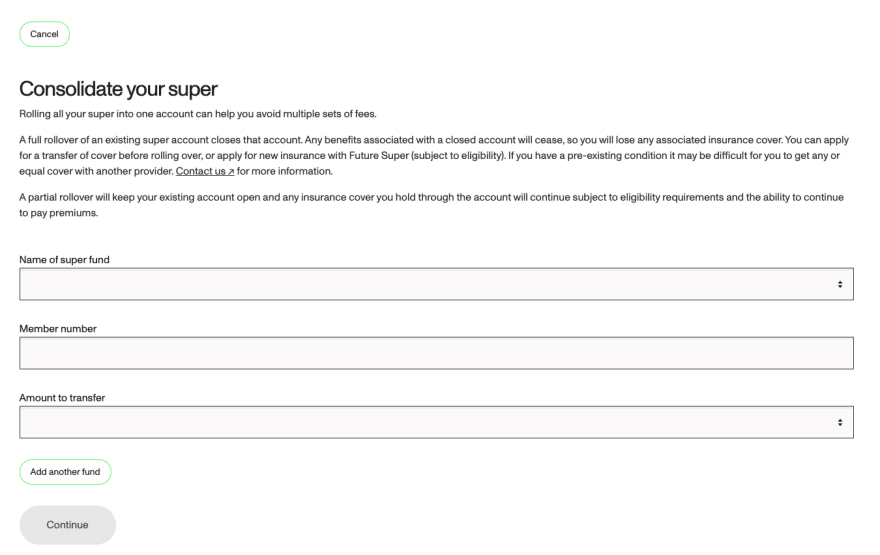

PermalinkIf you have super with another fund and you would like to move this money to Future Super, here's how to do it:

You should see the below form:

Please note, if you choose to transfer your whole balance, this will automatically close your old account as well as any insurance policy or other benefits attached to it. You should consider this before making a decision to rollover.

Rollover can take 3-7 business days to process. You will be able to view the transaction within your online account once processed.

To transfer funds from your Self-Managed Super Funds(SMSF) to your Future Super account, this will need to be arranged by the SMSF administrator.

Please get in touch with us at info@futuresuper.com.au or call us on 1300 658 422 for further information.

You can rollover any ATO held super you have through your MyGov account. You can find further information about how to do this here.

The above information is general information only and does not take into account any person's financial objectives, situation or needs. We recommend that you seek professional financial advice tailored to your own personal circumstances before deciding to rollover to Future Super.

PermalinkYou can transfer any ATO held super you have, as well as your old super funds via your MyGov account. Here’s how to do it:

Please note that rolling your whole balance over to Future Super will close your other super account and cancel any insurance that you hold through this account.

We’ll take care of the rest! Rollovers from other funds usually takes 3–7 business days to process. However, please note that processing times to roll over ATO held super varies and is subject to the ATO’s timeframes.

PermalinkYes. Future Super takes part in the Trans-Tasman Portability Scheme. Get in touch with us at info@futuresuper.com.au to find out how.

PermalinkWhen we launched in 2014, Future Super was the first super fund to not invest in fossil fuel companies and remains the only super fund to screen out diversified fossil fuel companies and companies providing significant services and financing to the fossil fuel industry.

At Future Super we use a three-step process to ensure your money is invested in companies that can both grow your super savings and build a better world. You can see our full screening strategy here.

First, out with the bad: our negative screen rules out what we believe to be harmful and destructive industries like fossil fuels, detention centres, live animal export, nuclear, tobacco and more.

Second, in with the good: our positive screen ensures we actively seek out companies that are doing social and environmental good, such as renewable energy, healthcare, education and IT. You can view a full list of the companies we invest in here.

Finally, our team look for positive industries like solar farms and other impact investments to add to the portfolio. Our renewable energy portfolio includes the Bald Hills Wind Farm in Victoria and the Lake Bonney battery in South Australia.

PermalinkFuture Super has four investment options: Balanced Index, Balanced Impact,Renewables Plus Growth and High Growth.You can find a handy snapshot of our investment options on our website here.

All the details you need to make an informed decision about our products can be found in our Product Disclosure Statement, Target Market Determination, Additional Information Booklet, Insurance Guide and Financial Services Guide.

If you're unsure about whether one of these options is suitable for you, you should seek financial advice to ensure you are making an informed choice based on your own financial objectives, situation and needs.

PermalinkFuture Super now allows members to split their balances across multiple investment options. Previously, we required members to choose one investment option - so that meant 100% of your balance was invested in the option you chose. Now we've rolled out the ability for members to split their super into multiple options.

Here's how you do it: log into your member online account and click on b'Investment Options'. Then you will be able to select b'Manage Investments'. From this page, you will be able to choose to put all your balance in one option or to split your balance between multiple options.

You can choose your own allocation For example, you could put 50% in Renewables Plus Growth and 50% in High Growth or you could put 10% in High Growth and 90% in Balanced Index. It's 100% your call!

And remember, there's still nothing wrong with just choosing one option and having 100% of your balance invested in it.

We've introduced this new ability to split your super because we are launching the High Growth option. A 90% allocation to growth assets, which is what the High Growth option offers, is very high! This means the option is higher risk. By giving members the option to only invest in a portion of their super in High Growth, members can have more control over how much risk they are taking on.

The minimum portion of your balance you can allocate to an investment option is 5%.

PermalinkAustralian employers are required by Government legislation to make superannuation contributions for their eligible employees. These are called Employer Superannuation Guarantee (SG) contributions.

Generally, all employees are entitled to SG contributions, no matter how much they earn in a month. It doesn't matter whether you're full time, part time or casual, or if you're a temporary resident of Australia.

If you're under 18 years old, you must work more than 30 hours per week to be entitled to super contributions.

If you're a contractor, you may still be entitled to super from your employer. You can read more about super contributions for contractors here.

Please note, your employer's super contributions may be shown on your payslip, but employers will often transfer this money to your super fund every 3 months by the quarterly due dates.

Some people may have multiple accounts, so it is important to tell your employer about your Future Super account if you want your employer's contributions to be invested with us on your behalf.

Contributions made by your employer (including salary sacrifice) are taxed at 15%. As this rate is lower than most people's marginal income tax rate, these contributions are called Concessional Contributions.

Read more about contributions tax here.

PermalinkIf you'd like to grow your super balance, you can make personal contributions to your super directly from your bank account.

How to make a personal contribution to your Future Super account

You can use BPAY to make a payment (or recurring payments) from your bank account.

To find our BPAY biller code and your unique BPAY reference, log in to your Future Super online account and navigate to Contributions > Make a contribution.

Once we receive your contribution, our administrators will allocate it to your account. Please allow 2-10 business days for your contribution to be processed and appear in your transactions.

There are several types of voluntary contributions, including personal, spouse, and Downsizer contributions. To make a spouse or Downsizer contribution, you'll need to submit a Alternative Contribution Form. Please see the Australian Taxation Office (ATO)'s website for more information on different contribution types.

Annual contribution caps and tax deductions

The Australian Taxation Office (ATO) sets an annual contribution cap (per financial year), and if you go over this cap you may be required to pay additional tax - you cansee more information here. For the 2024/2025 financial year, the standard cap amounts are $120,000 for non-concessional contributions, and $30,000 for concessional contributions per financial year.

If you claim a tax deduction for your personal contributions, they become concessional contributions and are effectively from your pre-tax income. They will then be taxed in your fund at a rate of 15%. If you don't claim a tax deduction for them, they're non-concessional contributions and are from your after-tax income or savings.

If you wish to claim your personal contributions as a tax deduction, you need to submit a validNotice of intent to claim or vary a deduction for personal super contributions form (NAT 71121) (or Notice of intent). You can find further instructions about how to make aclaim on the ATO website here, and more information on how and when to submit a Notice of intent in our FAQs.

From 22 July 2023, some changes apply.

When you join Future Super we'll send you an email which you can forward to your employer. It will have all the details to help them make payments to your account.

If you're already a member and have just switched jobs, simply pass on our Standard Choice Form and General Compliance Certificate, and direct them to our Employer Hub.

They may need our USI (45 960 194 277 010), ABN (45 960 194 277) and your member number to pay super contributions to your account.

PermalinkTo be able to pay super contributions on your behalf, your employer may ask you to provide a letter from us stating that we are a complying fund and that we can accept employer contributions. This document is also known as the General Compliance Certificate.

Our General Compliance Certificate contains all the fund details which your employer may need to set up superannuation contribution payments.

This certificate can be found on the Documents and Forms page and on the Employer section of our website.

PermalinkEmployer Superannuation Guarantee (SG) contributions are presently 11.5% of a person's ordinary time earnings (subject to a maximum dollar limit). Some employers pay more than the minimum 11.5% but it's not allowable for employers to pay less than this.

You can read more about employer contributions on the government MoneySmart website here.

PermalinkIf you are under 18, you generally have to work more than 30 hours per week to be entitled to super contributions.

PermalinkYes. You need to organise salary sacrifice contributions directly with your employer. They will likely pay your salary sacrifice when they make your regular super guarantee contributions.

You can read more about salary sacrificing arrangements here.

Please note - Salary sacrifice contributions are subject to the concessional contribution cap. If you breach this cap, you may be required to pay additional tax. For the 2024/25 financial year, the concessional contribution cap is $30,000 per financial year.

For more information on contribution caps, please refer to this ATO webpage.

PermalinkNon-concessional contributions

Non-concessional contributions are able to be made to your account from your after-tax income and are not taxed when entering the fund.

There is a non-concessional contribution cap of $120,000 per financial year. You can read more here.

Concessional contributions

Concessional contributions are taxed at a 15% rate and are made to your account from pre-tax income. These contributions include those made by employers from your pre-tax income and self-employed people who may wish to make contributions from their pre-tax income and claim a tax deduction for those contributions. Members of other types of employment can also make personal concessional contributions.

The concessional contributions cap is $30,000 per financial year. You can read more here.

PermalinkThe super contributions your employer makes from your before-tax income (concessional contributions) are taxed at 15% by the Australian Taxation Office (ATO).

This tax component is displayed in your transaction history as 'Contributions Tax' and is sent to the ATO by Future Super regularly.

Note - If you exceed the concessional contributions cap of $30,000 in a financial year, additional tax may apply.

The super contributions you make from your after-tax income (non-concessional) are not subject to tax unless you exceed the cap of $120,000 in a financial year. If you exceed the cap the excess will be taxed at the top marginal tax rate.

For more information on how super contributions are taxed and annual contribution limits see ATO's website.

PermalinkYour employer will be able to make Superannuation Guarantee (SG) contributions into your super fund for as long as you remain working. Employers will be required to make super guarantee contributions to their eligible employee's super fund regardless of how much the employee is paid. Employees must still satisfy other super guarantee eligibility requirements.*

If you are between 67 - 74 years old, you can make additional voluntary contributions. But, if you are intending to claim a tax deduction on your additional voluntary contributions, you will need to satisfy the work test that is recorded in your tax return instead.

Once you are over the age of 75, we will only be able to accept mandated Employer Super Guarantee contributions or a Downsizer contribution (if eligible).

PermalinkYou are required to satisfy the work test if you are between 67-74 years old and wish to claim a tax deduction on your additional contributions to your super.

The work test requires you to be gainfully employed for at least 40 hours during a consecutive 30-day period during each financial year in which you intend to claim a tax deduction on the contributions that are made.

Please note that the work test is your responsibility and is not administered by your superannuation fund.

If you do not satisfy the work test, you may still able to make additional contributions to your super. However, you will not be able to claim a tax deduction on these contributions unless you meet the b'work test exemption'.

PermalinkIf you are under 75 years old, you will no longer need to meet the work test to make or receive non-concessional super contributions and salary sacrifice contributions.

However, if you are between 67 to 74 years old, you will be required to meet the work test in order to claim a personal superannuation contribution deduction.

If you cannot meet the work test, you may still be able to claim a tax deduction for personal superannuation contributions where all of the following requirements are satisfied:

• You met the work test (see below) in the financial year immediately prior to the year of the contributions, and • You had a total super balance of less than $300,000 at the end of the previous financial year, and • You have not previously used the work test exemption in a previous financial year to make a contribution to a super fund.

To meet the work test under the work test exemption rule, you must have been gainfully employed for at least 40 hours during a consecutive 30-day period in the financial year immediately prior to the year in which the contributions are made.

You should consider speaking with a professional financial advisor before making any financial decisions.

PermalinkIf you are aged 55 or over and have recently sold your home, you may be able to make a voluntary super contribution of up to $300,000 from the proceeds of sale. Eligibility criteria apply.

Downsizer contributions do not count towards contribution caps and you will not need to meet the work test.

However, Downsizer contributions do count toward the $1.9m transfer balance cap for transferring super into the retirement phase.

There are a number of requirements to assess your eligibility for the Downsizer contribution. You can read more about the eligibility requirements on the ATO website here.

You should consider speaking with a professional financial advisor before making any financial decisions.

PermalinkYou may be able to claim a tax deduction for any personal super contributions that you’ve made from your after-tax income (known as non-concessional contributions).

Download the Notice of intent to claim or vary a deduction for personal super contributions form from the ATO site. (You may see this referred to as a N71121 form). You can find the ATO’s instructions on filing a notice of intent to claim here.

The form will ask for some personal details, like our fund details, your member number with Future Super, and the amount you wish to claim. A few things to note: Fund name: Future Super Fund ABN: 45 960 194 277 USI: 45 960 194 277 010 You can complete your form digitally, but we require a wet signature (physically signed with a pen). You are not required to provide us with your TFN - we already have this on file from when you joined. We cannot accept forms that contain duplicate signatures, crossed out sections, or sections concealed with whiteout or tape. If you’ve made a correction on your form, please make sure the correction is clear, then initial and date next to any changes

Submit your form to us! You can email a scan or photos of your completed form via email to info@futuresuper.com.au Alternatively, you can post the form to: Future Super GPO Box 2754 Brisbane QLD 4001

When you submit a notice of intent to claim, a concessional tax of 15% will be applied to the contribution amount you’re claiming. (This will only occur if a contributions tax has not previously been withheld). The personal contribution amount to be claimed as a tax deduction will then become a concessional contribution and will count towards your concessional contributions cap ($30,000 for the current financial year).

If you claim a tax deduction when completing your tax return, this may lower your taxable income – so depending on your income tax bracket, you could pay less tax. For people in several income brackets, 15% is lower than their marginal tax rates - you can see more on tax rates at the ATO. Not everyone is eligible to make a tax deduction - the eligibility criteria and more information are listed here. If you’re not sure whether claiming personal contributions as a tax deduction suits your circumstances, we recommend you seek personal financial advice.

If you need to vary your notice later, you can do so provided you haven’t filed your tax return for the financial year in which you have made your contributions. You can submit a variation to an earlier notice if you’d like to claim less than you originally nominated - if you’d like to claim more, you can simply submit as a new notice of intent to claim with updated totals. You can see our guide here on how to vary an early notice.

PermalinkIf you intend to claim a tax deduction for any personal super contributions that you've made from your after-tax income, you'll need to submit a Notice of intent to claim or vary a deduction for personal super contributions form to your super fund before the relevant deadline.

You need to submit your form by the earlier of either:

For example, if you made personal contributions in the 2022-2023 financial year, you're required to submit your Notice of Intent either before you lodge your 2022-2023 tax return, or before the end of the next financial year (30th June 2024), whichever comes sooner.

You find further instructions for completing and submitting a notice of intent to claim or vary a deduction for personal super contributions form in our FAQs as well as on the ATO website.

Please note that as stated in Section D: Declaration of the form, we can only apply a Notice of intent to claim or vary a deduction for personal super contributions to your account to a) contributions received by and currently held by Future Super, and b) while you are a current member of Future Super.

We are not able to apply your notice to any personal contributions that you made to another fund prior to rolling over to Future Super, or to any contributions made to your account while you were a member if you have exited the Fund before filing your notice of intent to claim.

PermalinkIf you've already submitted a notice of intent but now intend to claim a different amount as a tax deduction, you can do so as long as you haven't filed the tax return for the financial year in which you made your contributions.

The procedure to vary the amount will be different based on whether you intend to claim more or less that you nominated in your original notice of intent.

If you intend to claim more, you can submit a new notice of intent instead of submitting a variation to your previous notice:

If you want to reduce the amount you intend to claim as a deduction, you will need to lodge a variation to your original notice of intent sent to us:

You can find further instructions for varying your notice of intent to claim a deduction for personal contributions on the ATO website here.

Please note that you can only vary a previous valid notice if we currently hold the full contribution covered by the previous valid notice, and you are still a member of the fund. We are not able to amend your notice for a) any contributions made to a previous super fund prior to rolling over your funds to Future Super, or b) any contributions made to Future Super that have been rolled over to a different fund.

PermalinkYou should submit a Notice of Intent form to Future Super if you have made personal contributions to your Future Super account and wish to claim the partial or full amount of these contributions as a tax deduction.

You can read more about what a personal contribution is on this ATO page.

You can claim a tax deduction for personal contributions made in the current or previous financial year, provided you have not lodged your tax return for that year.

PermalinkFirst, you may wish to double-check your employer has all the correct details. This includes:

This information can also be found on the Employers page of our website .

If your employer is still having trouble contributing to Future Super, they can get in touch with us directly by calling us on 1300 658 422 or emailing us at info@futuresuper.com.au.

PermalinkBaby Bump is a refund of the annual dollar-based administration fee for the time you are on parental leave, up to a maximum of 12 months (equivalent to $60).

We created Baby Bump for two reasons:

These two factors contribute to the startling gender inequality in super - that, on average, women retire with 42%* less super than men. So Baby Bump is Future Super's baby step towards making super more fair for our members.

You don't have to be the birth parent to take advantage of our Baby Bump policy however. If you have welcomed a new child into your family and taken parental leave or left work to care for that child, you can apply for the Baby Bump regardless of your gender.

For more information on eligibility and how to apply please see this page.

*See Closing the super gender gap (Philip Clark for ABC 2021)

PermalinkFuture Super supports those on parental leave through a program called Baby Bump. Baby Bump is a refund of all or part of the annual dollar-based administration fee for the time you're on parental leave or have left work, up to a maximum of 12 months ($60).

For more information on eligibility and how to apply please see this article.

PermalinkEach of our investment options have different fees. You can find out information about these fees on our website under each investment option. An overview of our investment options can be found here.

For a detailed breakdown of fees, how we apply them and more information on our services, please read the Product Disclosure Statement, Additional Information Booklet and the Financial Services Guide.

PermalinkLike all super funds, Future Super needs to charge fees so that we can run our business and ensure that your money is having the most impact that it can. Fees pay for things like establishing and administering your account, investing your money, running our tech systems, and our wonderful Member Advocacy team.

Our members pay direct fees (also known as dollar-based fees), and percentage-based fees. All of our investment options have a dollar-based administration fee of $60 per annum, and percentage-based administration and investment fees, indirect costs and buy-sell spreads, that vary depending on which investment option you are invested in. Information about these fees is published on our website under each investment option, and on the investment option overview page.

Individual members may also pay direct activity fees, such as insurance premiums, if they elect to take up an optional benefit provided by the Fund, such as life insurance.

Our members are the most important thing to us, and, as such, it is our intention to reduce our fees over time and as we grow.

For a detailed breakdown of fees, how we apply them and more information on our services, please read the Product Disclosure Statement, Additional Information Booklet and the Financial Services Guide.

PermalinkFuture Super's insurance provider have a whole bunch of information on how likely different people are to claim on an insurance policy. They use that information, along with your personal information, to work out how much they need to charge you for cover.

For Death Cover, as well as Death and Total and Permanent Disablement Cover, the information they from you to provide a quote is your age, your legal gender, the state you live in, and your occupation category. If you are applying for Income Protection, they need all of this as well as your annual income.

This information is only used to provide you with an indicative quote, if you chose to go ahead with the policy, the Insurer may require more personal medical information.

We use this information to calculate your quote, but we don't store your data for your privacy.

If you would like to retain a copy of your quote, please make sure you download it at the end of our online insurance quote tool.

PermalinkFuture Super offers opt-in insurance. You can apply for cover for the following types of insurance:

Death Only and Death & TPD cover helps provide you or your dependents (as applicable) with a lump sum payment in the event that you die, suffer a terminal illness, or you become totally and permanently disabled (where you have Death & TPD cover).

Income Protection cover provides you with a monthly income calculated in accordance with the relevant insurance policy (b'Monthly Benefit') in the event that you become Partially Disabled or Totally Disabled and a Sickness or Injury causes you to be unable to work and earn an income.

Po;?lease visit this page on our website for an overview of our insurance process.

You can read more about our insurance offerings and the terms and conditions in our Insurance Guide,Product Disclosure Statement,Additional Information Booklet andFinancial Services Guide.

Before applying for insurance, you may wish to review the possible premiums you may be subject to. To check what premiums may apply, you can get a quote for any of the types of coverage using our online quote tool here.

When you first join Future Super you have 60 days to apply for ourEasy Opt-InStandard Cover via youronline account. This option is only available for Death Only and Death & TPD cover and will provide a standard amount of cover based on your age and occupation. The standard amount of cover changes in accordance with your age on your next birthday. The premiums for Standard Cover are based on your age next birthday, sex and occupation.

Please note, Easy Opt-in Insurance will commence only once you have a balance in your account. You can read more about Easy Opt-In Standard Cover on page 5 of theInsurance Guide.

If you currently hold insurance with a different super fund, you may be eligible to transfer your cover. Email us atinfo@futuresuper.com.au to find out more.

Note: Insurance is not available for pension account holders.

PermalinkThere are three ways you can apply for insurance with Future Super!

Before applying for insurance, you may wish to review the possible premiums you may be subject to. To check what premiums may apply, you can get a quote for any of the types of coverage using our online quote tool here.

You may also want to visit this page on our website for an overview of our insurance process.

Easy Opt-In Standard Insurance

When you first join you have 60 days to apply for our Easy Opt-In Standard Insurance via your Online Member Portal. This option is only available for Death and Death & TPD cover. This will provide a default amount of cover based on your age and type of work subject to eligibility.

Voluntary Insurance Application

If you are an existing member whose 60 days has expired or you wish to apply for Income Protection, you can apply through our Voluntary Insurance Application. This method is more lengthy but it does allow you to pick the amount of coverage for Death and Death & TPD that best suits you. With Income Protection, you can apply for a coverage amount of up to 75% of your pre-claim salary with a maximumbenefit period of 2 years (or until age 65 if earlier). You will also need to select an appropriate waiting period.

Insurance Transfer

If you currently have insurance with an existing fund, you may be eligible to transfer this cover. To do this, you will need to fill in the transfer form and provide proof of cover that is no older than 30 days. Please note, your existing cover should be active at the time of transfer. Please contact info@futuresuper.com.au for this form or for more information.

You should read our Insurance Guide, Product Disclosure Statement and Additional Information Booklet before making any decisions relating to insurance with Future Super.

PermalinkInsurance premiums are deducted monthly (in arrears) from the balance of your super. The premiums will be deducted automatically once your cover commences.

Standard cover commences on the later of the date your opt-in request is accepted by the Insurer and the date when your first super contribution (rollover, employer SG contribution or personal contribution) has been received by the Future Super.

For more information, please see our Insurance Guide.

PermalinkWe require written confirmation for all cancellations. You can, at any time, cancel your cover by writing to us at info@futuresuper.com.au and we will send you a confirmation letter when your insurance cover is ceased.

We also require written confirmation if you would like to decrease your cover amount. You can, at any time, decrease your cover by writing to us at info@myfuturesuper.com.au and we will send you a confirmation letter when your new insurance cover is confirmed.

If you would like to increase your cover amount, you will be required to go through the underwriting process. You can send us an email at info@futuresuper.com.au to obtain a quote or an application form.

For more information, please see our Insurance Guide.

PermalinkTo certify your ID, you will need to scan and print a copy of photo ID, like your passport or drivers licence. You will then need to get the copy certified by an authorised person.

Please see the following list of people who can certify your ID:

You must have the copy of your identification document(s) certified as being a true copy of the original document(s). The person who is authorised to certify documents must sight the original and the copy to make sure both documents are identical, then make sure all pages have been certified as true copies by writing or stamping 'certified true copy of the original' followed by their signature, printed name, occupation, contact number and date.

Please also note the certification has to be on the same page as the copy of the document, for example it cannot be on the back of the document.

To ensure your certified copy of your ID is acceptable, please read our factsheet on Certified ID.

Note: If your proof of identity documents are in a language other than English, they must be accompanied by an English translation prepared by an accredited translator. Read more about translating proof of identity documents here.

PermalinkYes.

If your proof of identity and/or linking documents are in a language that is not understood by the person carrying out the verification, they must be accompanied by an English translation prepared by an accredited translator.

Any document that has been certified in a language other than English must also be translated to English by a person authorised to do so. According to ASIC (the Australian Securities & Investments Commission), a translation made outside of Australia must be certified as a correct translation into English by:

This information is available on the ASIC website.

PermalinkWe do! We send out member statements annually, however if you need one in the meantime, send us an email at info@myfuturesuper.com.au and we'll do our best to get an unaudited interim statement to you within 2-3 business days.

PermalinkYou can view your account online at any time. You can also call us on 1300 658 422 or email us at info@futuresuper.com.au with any questions.

Please note our contact hours are 9:30am to 4:30pm Monday to Friday.

PermalinkYou can log in using your member number, email or phone number. If you cannot log in on one browser try using a different browser (e.g. Google Chrome, Firefox, etc.).

You can alsoreset your password on the login page.

If you still cannot access your account, send us an email atinfo@futuresuper.com.au or call us on 1300 658 422 and we'll be happy to help you out.

PermalinkYou can view your annual member statements that are available under the Transactions section of your online account.

Note, member statements are audited and distributed after the end of each financial year (after June 30th) and before 31st December. Members will be notified once they are available.

PermalinkFor your account to be affected under Protecting Your Super, the following criteria would need to be met:

An Inactive low balance account is essentially a super account with a balance below $6,000 and none of the actions as stated in the above section have occurred in the past 16 months. The result of this is that the balance will be transferred to the ATO.

An inactive account for insurance purposes is where contributions have not been received in your account for the past 16 months and that you have not let us know that you'd like to continue to hold insurance cover.

Reporting dates:

The dates for super funds to report inactive low balance accounts each year are 30th June and 31st December.

To find out more:

To find out your super balance, you can log in to your online account or contact our team on 1300 658 422 or info@futuresuper.com.au.

You can learn more about the rules around inactivity and how the Protecting Your Super laws may affect you on theATO website and theAPRA website.

PermalinkTo prevent your account from being rolled out to the ATO, you are required to make a financial change on your superannuation account. This could be one of the following:

You can also provide us witha written notice electing not to be a member of an inactive low-balance account. The easiest way to do this is via ouronline form.

If you have any issues with the online form, you can also reach out to us via email toinfo@futuresuper.com.au.

Administration and investment fees charged cannot exceed 3% of the balances of accounts with less than $6,000.

If your account balance is less than $6,000 at the end of the financial year, any amount charged in excess of the 3% cap will be refunded.

Please note that the following fees are not included in the fee cap:

To;?o learn more about our fees and how we apply them, please see our Product Disclosure Statement.

To prevent your insurance cover being cancelled, you are required to make a financial change on your superannuation account.

This could be one of the following:

You can make an election to keep your insurance cover by emailing us at info@futuresuper.com.au and specifying the following information:

An election is enduring and only needs to be made once.

More information on insurance in super can be found here. If you want to know more about the insurance cover types specific to Future Super, please see the Insurance Guide.

If you want to make changes to your account so that this will not impact you, log into your online here or get in touch with our Member Advocacy team on 1300 658 422 or info@futuresuper.com.au

You can learn more about the rules around inactivity and how the Protecting Your Super laws may affect you on theATO website and theAPRA website.

PermalinkIf you have received an exit notice or are not able to log into your online account, it's possible your account may have been closed. This may be for a few reasons, including:

You have recently withdrawn the full balance of your account. This will automatically close your account.

Your account was identified as an Inactive Low Balance Account and transferred to the ATO under Protecting Your Super laws. These transfers generally occur in April and October each year. Learn more about Protecting Your Super here.

Note - If your account was impacted by the Protecting Your Super rules, you should have received a letter to your registered email address. We recommend checking your spam or junk mail for this notice.

Your account has been identified as an inactive account under regulations for Unclaimed Super Moneys and was swept to the ATO. You can find out more information about Unclaimed Super Moneys here.

Yo;?our account had zero balance and you had not transacted on the account in the last 12 months.

Note - If your account was identified as an inactive zero balance account, you should have received a letter to your registered email address. We recommend checking your spam or junk mail for this notice.

If you are having issues with your account, or would like to reactivate your account, you can get in touch with us on 1300 658 422 or send us an email to info@futuresuper.com.au.

PermalinkTo change your name please send us a completedChange of Details form along with acertifiedcopy of ID with your new name to:

Future Super

GPO Box 2754

Brisbane QLD 4001

For more information on how to obtain a certified copy of your ID please see this article.

PermalinkYou can update your residential address and mobile number via the Member Portal.

To update your email address, or other contact details, you can give our member advocacy team a call on 1300 658 422 or send us an email at info@futuresuper.com.au.

We will need to verify a few details for security purposes, such as your full name, member number and date of birth.

PermalinkYou can nominate a Dependant or your legal personal representative as a binding beneficiary. If you nominate your Legal Personal Representative it is important that you have a valid Will and keep it up-to-date, as the Trustee may pay your death benefit to your estate.

Under superannuation law, your “dependants” include the following:

Someone can be in an interdependent relationship with you if: you have a close personal relationship, you live together, one or each of you provides the other with financial support, and one or each of you provides the other with domestic support and personal care. Dependency can also arise where two people have a close personal relationship but don’t live together or provide each other with financial support or personal care because of physical, intellectual or psychiatric disability.

PermalinkTo nominate a binding beneficiary you must complete the Binding Nomination of Beneficiaries Form and send it to us at:

Future Super GPO Box 2754 Brisbane QLD 4001

To nominate a non-binding beneficiary you need to complete the Non-Binding Nomination of Beneficiaries Form. You can return it by email to info@futuresuper.com.au, or send it in hard copy to:

Future Super GPO Box 2754 Brisbane QLD 4001

Once it is processed it will appear in the 'view beneficiaries' section of your Member Portal.

PermalinkA beneficiary is someone you want to receive the money in your super account in the event you pass away. You can read more about how super is handled in the event you pass away on this ATO page here.

You can make either make a binding or non-binding nomination. You can read more about the differences between the beneficiary types here.

To;?o find out how you can apply for a beneficiary with Future Super, please see this page.

PermalinkA binding death benefit nomination is a written direction made by you to the Trustee that sets out the dependants and/or legal personal representative, as decided by you, who are to receive your benefit in the event of your death. So long as the binding death benefit nomination is valid, the Trustee is bound to follow it.

A non-binding death benefit nomination is a written request made by you that suggests to the Trustee the beneficiaries that may receive your benefit in the event of your death. The Trustee has the final say as to who should receive your death benefits. The Trustee will consider your nomination but is not bound to follow it. The Trustee has the discretion to pay to any one or more of your dependant(s) or legal personal representative(s) or a combination of both.

PermalinkTo withdraw some or all of your superannuation, you will need to satisfy a condition of release.

To satisfy a condition of release, you will need to have either:

Generally you will need to have reached your preservation age before satisfying a condition of release. There are a limited exceptions, including:

If you believe that any of the above apply to you, please see our section on early release of super.

PermalinkSuperannuation is designed to help you save for retirement, however, there are some limited circumstances where you may be able to access your super early, including:

Io;?f you are below preservation age, you may be eligible for early release of super if all of the following apply to you:

To;?he maximum amount that can be withdrawn is $10,000 less tax. (See how tax is applied here).

Io;?f you are older than preservation age plus 39 weeks, you may be eligible for early release of super if the following apply to you:

There are no restrictions on how much you can withdraw if you meet the age requirement and the other 2conditions.

Read more about how to apply for an early release of super on the grounds of severe financial hardship in our information sheet.

There are very limited circumstances when you may be allowed to withdraw some of your super on compassionate grounds for unpaid expenses, where you have no other means of paying for these expenses. The amount of super you can withdraw is limited to what you reasonably need to meet the unpaid expense.

Compassionate grounds include needing money to pay for:

Note, applications for early release of super on compassionate grounds must be completed through the ATO.

If successful, we'll need you to submit ourwithdrawal form along with acertified copy of your photo ID to be able to pay your benefits to you.

You may be eligible to access your super if you have a permanent physical or mental medical condition that is likely to stop you from ever working again in a job you were qualified to do by education, training or experience.

To;?o learn more and apply for a withdrawal, please see our Application for Early Release of Super due to Permanent Incapacity form.

This condition of release is generally used to access insurance benefits linked to your super account and may be applicable if you are temporarily unable to work, or need to work less hours, because of a physical or mental medical condition.

Po;?lease see our Insurance Guide for more information about insurance options with Future Super or contact us for more information about an early release of super due to temporary incapacity.

You may be able to access your super if you have a terminal medical condition. You will need to meet the following to be eligible:

To;?o learn more and apply for a withdrawal, please see our Application for Early Release of Super due to a Terminal Illness form.

The First Home Super Saver (FHSS) scheme was introduced by the Australian Government to reduce pressure on housing affordability for first home buyers.

From 1July 2018, you can apply to release your voluntary contributions, along with associated earnings, to help you purchase your first home. You must meet theeligibility requirements to apply for the release of these amounts.

You can currently apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $50,000 contributions across all years. You will also receive an amount of earnings that relate to those contributions.

Read more about the FHSS scheme and related processes on the ATO's website here.

If you have worked and earned super while visiting Australia on a temporary visa, you can apply to have this super paid to you as a Departing Australia Superannuation Payment (DASP) once you leave Australia. Eligibility conditions apply.

You can apply for DASP through the ATO.

Note, If successful, we'll need you to submit our withdrawal form along with a certified copy of your photo ID to be able to pay your benefits to you.

You may be able to access your super if your employment has been terminated and the balance of your super account is less than $200.

If you believe any of the above applies to you and would like further information, please reach out to our team at info@futuresuper.com.au or call us on 1300 658 422.

PermalinkIf you are finding that you are unable to meet immediate family living expenses, and you have outstanding debts, you may be able to access some of your super due to severe financial hardship.

For more information about eligibility and how to apply, please see our information sheet here.

For information about accessing your super early, please click here.

PermalinkSuper is intended to fund your retirement, so you can generally only access it once you have retired from working and have met a condition of release. To satisfy a condition of release you will need to meet one of the following:

There are some additional conditions that allow for early release of super.

PermalinkWe do participate in the First Home Super Saver Scheme. This means that voluntary contributions made after 1 July 2017 may be released from 1 July 2018. Members can save up to $15,000 per year and withdraw a maximum of $50,000 under the scheme.

You can make personal contributions by arranging a salary sacrifice arrangement with your employer, or by making personal contributions via your member portal. Please note that the amount you are eligible to withdraw is assessed by the ATO and any questions about applying for FHSS should be directed to them.

Please see this link to the ATO's website for more information.

Please note, Super Guarantee (SG), Spouse Contributions and Government co-contributions cannot be released under this scheme.

PermalinkPlease complete a Withdrawal Form if you would like to apply to withdraw all or some of your super money.

PermalinkAn Account-Based Pension is a simple, single account for those who have met a condition of release and will no longer be making contributions to their super.

You can receive flexible payments (subject to age-based minimums) on a timeline that suits you, and make lump sum withdrawals at any time.

Please read our Product Disclosure Statement Pension Target Market Determination and other important documents before deciding to open a pension fund.

PermalinkA pension account needs an initial minimum investment of $20,000. This initial investment can be rolled over from your current super account, pension account or personal bank account. It's important to remember that you can't make further contributions once your pension account has been established.

PermalinkTo open a pension account you will need to satisfy a condition of release.

To satisfy a condition of release, you will need to have:

For more information about opening a pension, please read our Product Disclosure Statement.

PermalinkPension account holders receiving an income stream have to withdraw at least the minimum pension payment from their super, as part of their annual income stream. This is known as the minimum pension drawdown.

The annual minimum drawdown amount is set by the government and changes depending on your age.

To see more details on the minimum drawdown amount that applies to you, please see Table 11 at the bottom of this ATO page. You can also find this information on page 8 of our Pension PDS.

PermalinkYou can access money from your pension account at any time via either requesting an ad hoc pension payment or a withdrawal

Ad Hoc Payment An ad hoc pension payment counts towards your annual minimum drawdown amount. To request an ad hoc payment, you must email us from the email address we have on file for you with the following exact wording:

"I, (insert full name) born on (insert date of birth), wish to request an ad hoc pension payment for account (insert account number for pension account) for the amount of (insert amount)"

If you are under 60, the amount specified in your request will be considered the gross amount. Ad hoc payments are subject to the same tax treatment as your pension payments.

You can email this to us at info@myfuturesuper.com. Generally, provided an ad hoc is received before COThursday, your payment will be received by the Tuesday of the next week.

Withdrawal Payment

A withdrawal payment does not count towards your annual minimum drawdown amount but your transfer balance cap will be reduced by the amount of the withdrawal.

To request a withdrawal, you need to submit a withdrawal form either via email (to info@myfuturesuper.com.au) or post at: GPO Box 2754 Brisbane QLD 4001

If you are under 60, the amount specified in your withdrawal request will be considered the gross amount. Withdrawals may be subject to a different tax treatment as your pension payments.

The form must be signed with a wet signature (i.e. with a pen on paper) and needs to be submitted along with identification (electronic ID details on the form OR certified ID attached).

Withdrawals can take up to 10 business days to fully process.

You can nominate one or more of your dependants, and/or your Legal Personal Representative, to receive the balance of your pension account as a lump sum on your death, on either a non-lapsing binding or a non-binding basis. Please see this FAQ on how to nominate a beneficiary.

You may also choose to nominate your spouse as a Reversionary Pension Beneficiary to continue to receive a regular payment from your pension account after you die (see the FAQ ‘What is a reversionary beneficiary?’ for more information).

Under superannuation law, your “dependants” include the following:

Note that the definition of a “dependant” under tax laws differs from those above. Someone can be in an interdependent relationship with you if:

Interdependency can also arise where two people have a close personal relationship but don’t live together or provide each other with financial support or personal care because of physical, intellectual or psychiatric disability (e.g. one person lives in a psychiatric institution suffering from a psychiatric disability).

If you do not nominate a beneficiary, or your nomination is invalid, the Trustee may pay the balance of your pension account to your dependants or your legal personal representative as it sees fit.

PermalinkA reversionary beneficiary is a nominated beneficiary applied during the application process of the pension account that dictates who will continue to receive a tax effective income stream payment (called a b'Reversionary Pension') in the event of a pension member's passing.

You can nominate your spouse (including a de facto spouse) as a reversionary beneficiary. In some instances, you can also nominate your child as a reversionary beneficiary. More details on who you can nominate can be found on page 9 of the pension PDS.

Once your pension account in the Future Super Pension Plan has commenced, your reversionary beneficiary nomination cannot be changed, except in very limited circumstances (such as the death of the nominated spouse or on divorce or separation).

If your reversionary beneficiary does not survive you, the remaining balance of your pension account will be paid out at the discretion of the Trustee, taking into account any nomination of beneficiaries you made prior to your death.

PermalinkYou can choose your regular retirement income to be paid from your pension account monthly, quarterly, half-yearly or annually, to your nominated bank, building society or credit union account.

Your pension payment will be credited to your account on the 15th of the month (or the next business day if the 15th falls on a weekend or public holiday).

You can vary the amount and frequency of these payments at any time to suit your needs as long as you meet the minimum drawdown requirements.

If you would like to change the frequency of your payments, please contact us at info@futuresuper.com.au. Please ensure you contact us from the email address we have on file for you and you provide a confirmation of 3 points of ID (e.g. your member number, full name and date of birth) in your email to us.

PermalinkTo set up a pension account you can complete apension application form and post your completed form to:

Future Super GPO Box 2754 Brisbane QLD 4001

For all the important information needed to make an informed decision about joining the Future Super Pension Plan please read our Pension Product Disclosure Statement andPension Plan Target Market Determination.

PermalinkA Future Super pension account allows you to draw a regular income from your retirement savings while investing them in line with your values.

You can choose to get monthly, quarterly, half-yearly or annual payments and you can usually choose how much you receive (within the mandated minimums outlined in the Pension Product Disclosure Statement).

PermalinkProtecting Your Super refers to a legislative package designed to protect superannuation members with a low balance account from erosion by fees and insurance premiums, and to help people avoid having multiple super accounts they didn't know about.

The Federal Government's Protecting Your Super package came into effect on 1 July 2019.

Under these changes, there are two separate components in relation to inactivity.

You can learn more about the rules around inactivity and how the Protecting Your Super laws may affect you on the ATO website and the APRA website.

The dates for super funds to report inactive low balance accounts each year are 30th June and 31st December.

PermalinkElectronic Service Addresses (ESAs) are used primarily by self-managed super funds (SMSFs).

Future Super is not an SMSF but an APRA-regulated fund, so you won't need an ESA. Please see below for all the information your employer will need to make contributions into your Future Super account.

Registration details for Future Super are as follows:

Your employer can find out more information about how to pay your super contributions in our Employer Hub.

If your employer is asking you to complete a Standard Choice form, you can download one with all of Future Super's pre-filled details here. All you need to do is add your personal details and your Future Super member number.

Your employer may also ask you to provide a letter confirming we are a compliant fund. This is known as a General Compliance Certificate and you can download it here.

If you have any further questions about making contributions to your Future Super account, please email info@futuresuper.com.au or call 1300 658 422.

At Future Super we take the security of your account very seriously.

We always encourage you to never enter your personal and account details anywhere other than in direct communication with us at Future Super. The only way we’ll contact you is via our phone number or email address listed on our Contact Us page. You may also receive text notifications via SMS for authentication purposes or app notifications if you use the Future Super app.

We will never call you from a standard mobile number. If you think you’ve been targeted by someone who is trying to access your super, or your identity details have been leaked, report it straight away.

You can see lists of known scams online and guides to avoiding them, including Scam Alerts (ATO.gov.au), Types of scams (ScamWatch.gov.au), and Superannuation Scams (Moneysmart.gov.au).

**What should I look out for? **

Be careful where you share your information If scammers gain enough of your personal details, they may be able to create a super account in your name with another fund, or their own Self Managed Super Fund, then transfer your balance to this account. They may also gain access to your myGov log in and any accounts attached to it.